Profitability in real estate: what is meant and how it is calculated

What is the rate of return on property and how to calculate it?

The calculation of the profitability in the real estate sector is one of the aspects that must be taken into account when purchasing a property, especially if it is purchased for investment purposes. In the case of real estate for own use, the calculation of economic sustainability is used; this is crucial for banks when they receive a mortgage application.

Nowadays, buying a property is advantageous compared to renting it due to low interest rates. However, before taking this step, it is essential to make the necessary considerations. The return on property is an important factor and there are calculation criteria to determine an estimated value.

What is the profitability of a real estate investment?

This is a calculation of the expected rental income for a property in percentage terms.

The factors on which the formula is based are essentially four:

– Annual rental income

– Maintenance costs

– Purchase price

– Mortgage interests

The annual rental income is not so difficult to determine.

This depends on many factors such as the type of property, whether it is for commercial or residential purposes, the region in which the property is located, the tourist potential and, last but not least, the market situation.

In Switzerland, in recent years we have seen an increase in the number of empty apartments that are not rented due to very attractive mortgage rates. This has an impact on rental income and related investments. However, there are other arguments that need to be taken into account.

In Switzerland, a good net return is between 3.0% and 4.5%. However, when talking about high profitability, we cannot rely solely on purely mathematical calculations. The potential of the property in the future and any increase in its value must also be taken into account.

According to a UBS Real Estate Focus 2020 publication, young people tend to prefer renting apartments in the city center. For the same price, apartments in the city offer a smaller surface area than apartments in the suburbs. However, the first ones are more attractive thanks to the services offered by a city centre.

But how do you calculate the profitability of a property?

First of all, let’s calculate the level of the expected gross annual rent income. As already mentioned, we need to assess the type of investment, whether this is a family apartment, a student apartment or a commercial property. The rental income also depends on the current situation in the real estate and economic market, as well as the number of properties not rented in the same area.

When talking about a holiday rental property or a student apartment, it must be considered that the property may remain empty for certain periods of the year, so the flow of tourists or the number of potential students is decisive to make a realistic projection.

The second aspect to be considered are fixed costs such as non-allocable running costs. These are the deposits to be paid into the renovation fund, the reserves for repairs or renovations of the individual private unit, the percentage of risk that the property will not be rented out immediately, as well as the administrative expenses, insurance and tax costs and related mortgage interests. The net rental income is the sum of the annual rental income minus operating expenses.

The purchase price is an additional parameter for the calculation. In order to obtain this value, the costs of a possible renovation and the bureaucratic costs associated with the purchase of a property must be assessed; here we are talking about notary fees, transfer of ownership tax which varies from canton to canton and cadastral taxes.

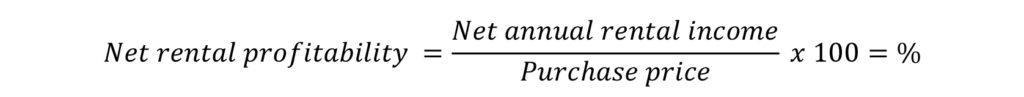

We now have all the parameters to calculate the net return on our property and apply the following formula:

Annual net rental income divided by purchase price per 100 equal % net income.

Example

We buy a 4.5-rooms apartment for CHF 850,000.00 and rent it for CHF 2,500.00 per month. The additional costs, such as electricity, heating and a percentage on the maintenance fees, are paid by the tenant, while the unallocated operating costs, as well as mortgage interests, renovation fund, extraordinary expenses and others, are paid by the owner. Hypothetically, these costs covered by the owner will amount to CHF 6,000.00 per year.

Rental income CHF 30,000.00 – Operating costs CHF 6,000.00 = CHF 24,000.00/CHF 850,000.00 x 100.

This results in a net annual return of 3.53%.

This simple example shows how much more interesting a good real estate investment is than simply parking capital on a bank account.

Excellence at your service.

Often the research and comparison of numerous real estate offers is confusing. Sometimes, for the less experienced, it is complicated to understand which are the good investments and recognize those that are too risky. The Jetika Group team is composed of highly qualified professionals. In our group we have a Master in Economics, a graduate in Economics, a trustee and auditor, an expert connoisseur of the real estate market with 35 years of experience, a Master in architecture and several professional sales consultants. We work closely with a renowned ISO real estate appraiser and surveyor. We are able to offer our clients investment opportunities, accompanied by detailed reports that allow a clear and transparent overview.

Jetika Group is at your service to present and search for opportunities that suit your needs.